|

Arborfield

|

|

Families

Related sites:

|

The Simonds family name lives on in the district, even though the family has moved away. In nearby Shinfield, it's possible to see the Simonds Brewery name on the 'Magpie and Parrot' pub, while in central Reading, there's a brass name-plate for the Simonds Bank. The Brewery and Bank were closely connected at first, as the following article shows. The Bank grew out of the Brewery. With acknowledgements to Barclays Bank for this article, adapted from a booklet produced by the Bank.

SIMONDS BANK AND ITS CONNECTIONS WITH ARBORFIELD

ROOTS In 1781, William Blackall Simonds (1761-1834) formed a banking partnership with Robert Micklem (a draper), John Stephens (another brewer) and Robert Harris (mealman), with a capital of £4,000. Their office was on the east side of the Market Place, ‘between John Deane (to north) and Widow Bailey (on the south)’. Rent was £55 per annum. From 1793 onwards, William also acted as Town Treasurer of Reading at different times. W. B. Simonds came of prosperous yeoman stock and inherited a malting and brewing business in Reading from his father in 1782. At first his main interest remained in brewing, but his efforts to expand it were frustrated by restrictive licensing laws and price fixing by the more powerful Berkshire brewers.

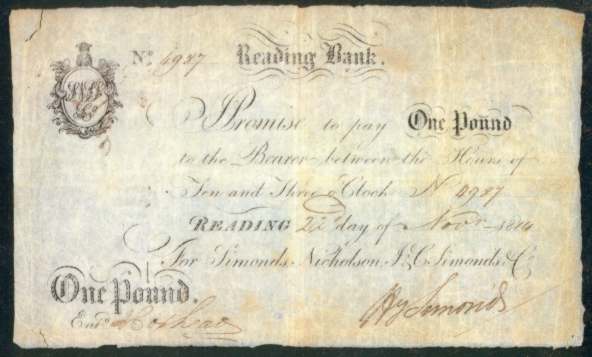

It was remarkable that W. B. Simonds was able to start a rival bank in the town immediately on breaking his original partnership agreement. It might have had something to do with the strength provided by two major accounts: the brewery and his son’s successful wine and spirit business. Further, he had been appointed Receiver General of Taxes for West Berkshire in 1791, and if he still held that position, then he could have used his tax receipts for up to six months before remitting them to London. In the meantime, the bank could have employed them for profit. The partnership was first represented in London by Messrs. Stephensons, Remmingtons and Smith of No. 69 Lombard Street, "at whose house their notes are payable", but by 1820 Williams & Co. had become their London Agents. In 1816 Ralph Nicholson withdrew from the partnership, and William Blackall Simonds also retired. He was in fact Mayor of Reading that year. From this time onwards the partners in the bank were all members of the Simonds family. Henry Simonds retired in 1839 and John and Charles continued under the title "John Simonds, Charles Simonds & Co. Reading Bank". It kept this name until it amalgamated with Barclay and Company in 1913. Back in 1791, Reading was primarily a communications centre based on the River Thames and the Kennet Navigation (later in 1810 the Kennet and Avon Canal linking the Thames to Bristol), and on its roads. Its industry was in decline. One industry to survive the decline in Reading was its speciality of converting barley into malt. It was considered to be the most important area for malting in Britain. The brewers and maltsters made a great use of the canals and River Thames especially to send malt to the London brewers. Thus, W. B. Simonds could see the chance to serve these interests at a profit. BRANCHES By 1913 when Barclays Bank Limited took over the Simonds interests, there were 12 branches. By today’s standards, this may not seem to have been a very significant expansion over nearly 100 years, but it is to be remembered that in those times the greater part of the country’s wealth was in comparatively few hands. For most country folk, the mattress or pot on the mantelpiece was adequate security for their meagre savings. The first branch was opened in 1816 only on Tuesdays at the Roebuck Public House, Wokingham, when the town held its Market. The Simonds name would have been well known and respected locally, as both John and Charles lived close by at Arborfield and Sindlesham. The business seems to have flourished, and it moved to new premises in 1855. John Simonds (the second) (1807-1876) noted the occasion in his diary as follows: 4th September 1855 – I rode "Blackbeard" to Wokingham. Withers brought the money by railway and we commenced business in the new shop – it is not quite complete but is very comfortable and approved of much by our customers. Five years after its first branch, in 1821 the bank opened at Henley-on-Thames, filling a gap left by the failure of the Henley and Oxford Bank in that year. The partners, by now all members of the Simonds family, were proving themselves to be sound bankers, keeping the bank’s general position under daily scrutiny. As a result, they weathered the financial crisis of 1825 without undue trouble. However, annual profits were modest from the start, and were only around £4,000 in 1844, even though a further office had been opened in High Wycombe in 1841. Another branch was opened in Yorktown in 1863, opposite the Royal Military Academy at Sandhurst. It operated twice a week at first, and then daily from 1887. This followed from a close business relationship, because W. B. Simonds had secured the beer contract with the Academy as far back as 1813, at the time that he was a brewer. No doubt some branches of the Bank were opened in places where the Simonds name was already well established, thanks to the sale of beer by the brewing side of the family. By this time, the connection between the two businesses was only a formal one, because inevitably the family relationship was becoming more remote from one generation to the next. The Basingstoke branch, opening in 1864, continued a link that went back to William Blackall Simonds’ marriage to the daughter of the Basingstoke brewer Thomas May. Branches followed at Crowthorne (early 1890’s), Camberley (1896), Bracknell (1899), Twyford (1899), Caversham, Oxford Road, Reading and Wargrave (all before 1905). When Barclays Bank took over the Reading Office and these 12 smaller branches, profits had risen to close on £25,000 in a year, and deposits were nearly £1 million. BANKNOTES Private banks of the time were allowed under Licence to issue their own notes. Simonds took advantage of this. Each note issued was carefully recorded by giving it a number and entering it in a Note Book. Here is an example of a Simonds banknote.

In the early 19th Century a great deal of Reading’s trade was done in London, mainly in agricultural products of one sort or another, and in particular in sending malt to the large breweries. It was therefore necessary for Simonds Bank to appoint London agents, usually other bankers, at whose office their notes were payable. Country banking, in its early beginnings, was established within a very restricted community and customer confidence was essential if the banks’ notes were to be readily accepted. Simonds achieved respect by building up a reputation for sound management, and their notes seem to have circulated freely. Amazingly, two five-pound notes and a ten-pound note that dated from 1888 - 1890 turned up again on 13th June 1932. They were presented by Westminster Bank Limited, Lombard Street office, to "The Local Directors, Barclays Bank Limited, 3, 4 & 5 King Street, Reading". Even though they had originally been issued by "John Simonds, Charles Simonds & Co., Reading Branch" forty years before, they were still honoured. FORGERIES It was not uncommon for attempts to be made to forge banknotes even in the early days of Note Issues. Substantial rewards were offered for arrests and convictions. Laws were harsh in those times, and one such forger was executed at Newgate Prison in 1779. John Simonds the second (1807-1876) mentioned forgery in his diary: 7th March 1848 Charles went to London on business, having heard that a party contemplated forging our notes and had employed a person to copy the plate. He set to work Forester, the officer, to find the delinquents. 23rd March 1848 Charles had gone to London to appear against some parties who had been attempting to forge our notes. They had applied to our engraver to copy our plate, but he had appeared an honest man and let us know the application. Charles had employed Tilliard, who had engaged Bush and Mullins, Solicitors to the Society of Protection of Bankers, and they very wisely set the Foresters to work, who managed the matters so well that I think there will be no doubt of their ultimate conviction. 7th April 1848 Charles went to London to prosecute forgers. The jury found a true Bill on Tuesday and he was ordered up to the trial today. They were convicted and sentenced to 10 years’ transportation each. ‘RUNS’ Simonds Reading Bank was established in stirring times, when everyone and every town was being affected by the industrial revolution and the vast improvement in communications. Reading was well placed to enjoy this new prosperity. It was also a time of intensifying economic crisis when lack of confidence in a local country bank could result in ‘runs’ – with deposits being quickly withdrawn and gold being demanded for notes. Many such banks failed as a result. There is no evidence that the confidence in Simonds Bank ever resulted in a ‘run’. However, an incident in the severe financial crisis of 1825 is worth recording. In that year, the bank was informed by its London Agents, Williams & Co., on the afternoon of 12th December that they would not open their doors the next morning. Charles Simonds at once chartered a coach, went up to London, and at 9 o’clock the next morning had an office open in Birchin Lane, immediately opposite Williams Bank, with a notice posted up "Reading Notes paid here". The Reading Mercury (forerunner to the Reading Chronicle) recorded on 17th December 1825 with pleasure that all the local banks had proved that people could be confident of their stability. Elsewhere, however, no fewer than 60 Banks failed between July 1825 and June 1826. FROM SMALL BEGINNINGS Back when W. B. Simonds formed his partnership, existing laws were designed to keep provincial banks small and local. There could be no more than six partners, and their personal wealth could be called upon to settle banking debts. Simonds Bank grew slowly but steadily, though by 1831 it still only had a capital of £4,000. Deposits from customers increased from £55,000 in 1831 to £421,000 by 1882 and £925,000 by 1913, while capital increased to £30,000 in 1882, and £100,000 when Simonds merged with Barclays. Profits were relatively modest; from £2,500 in 1832, they grew to £23,000 by 1912, a year before the merger. This might not have provided much income for the partners, but we do know that they had other interests besides banking. John Simonds the second was very much concerned with farming at Newlands, and with milling at Sindlesham. He also helped to run May’s Brewery in Basingstoke, into which W.B. Simonds had married. It is told that, on one occasion, after hunting a deer into the middle of Reading, John called at the Bank to see Charles (also the second), who was more regularly at the Partners Desk. MERGER WITH BARCLAYS An Act of 1826 established the principle of ‘Joint Stock Banking’ outside of London, which allowed Messrs. Barclay and Company to form a large organisation from 20 private banks in 1896. Barclays made repeated offers to merge with Simonds, and these finally bore fruit on 1st October 1913. Simonds announced the merger to their Customers as follows: "We have accordingly transferred our business to them, as from the 1st instant, but shall ourselves continue to have a direct connection with the business as Local Directors." The Local Head Office remained at the same address at 3 King Street, where the Simonds’ brass name-plate can still be seen. [Barclays Bank moved to a new office further west in Broad Street in 2011] ACKNOWLEDGEMENTS This text was adapted for the Arborfield Local History Society web-site from a booklet compiled by W. M. Herries, A.I.B., who in turn acknowledged help given by: David J. Simonds, a direct descendant (who generously provided copies of the booklet for the Local History Society to use in its Parish Centenery Exhibition in 1994); T. A. B. Corley, Senior Lecturer in Economics, Reading University; The then Berkshire Mercury newspaper; The then Royal Berkshire County Library; The Institute of Bankers’ Library. Reference was also made to: A History of Barclays Bank Limited – P. W. Mathews and A. W. Tuke; A History of the Town of Reading – Michael Hinton.

|

||

|

Any Feedback or comments on this website? Please e-mail the webmaster |

In 1814, thoroughly disillusioned, he decided to concentrate

on banking, and left his eldest son Blackall Simonds to run the brewery. He

dissolved his current banking partnership by mutual consent on 30th

July 1814, receiving, so it seems, only 15 shillings "in sterling money" from

his partners. On the next day established another banking house at No. 3 King

Street. His new partners were his younger son Henry (1795-1874), who had a

thriving wine and spirit business, two cousins John Simonds (1766-1845) of

Arborfield and Charles Simonds (1768-1859) of Sindlesham, who were in business

together as mealmen at Sindlesham Mill, and a Ralph Nicholson.

In 1814, thoroughly disillusioned, he decided to concentrate

on banking, and left his eldest son Blackall Simonds to run the brewery. He

dissolved his current banking partnership by mutual consent on 30th

July 1814, receiving, so it seems, only 15 shillings "in sterling money" from

his partners. On the next day established another banking house at No. 3 King

Street. His new partners were his younger son Henry (1795-1874), who had a

thriving wine and spirit business, two cousins John Simonds (1766-1845) of

Arborfield and Charles Simonds (1768-1859) of Sindlesham, who were in business

together as mealmen at Sindlesham Mill, and a Ralph Nicholson.